When I set out to advocate for fairness in tax treatment for Canadians with disabilities, there was every reason to be optimistic. Anyone with common sense surely could figure it all out and fix any problems in no time at all. How was I supposed to know that common sense and practical solutions do not prevail in government?

Instead, I would discover an obstructionist bureaucracy obsessed with balancing the budget, even when it meant denying a modest tax credit to the very people who need it the most. In order to achieve its goals, our government was systematically breaking the law and getting away with it. No wonder, previous efforts to reform the Disability Tax Credit (DTC) had failed.

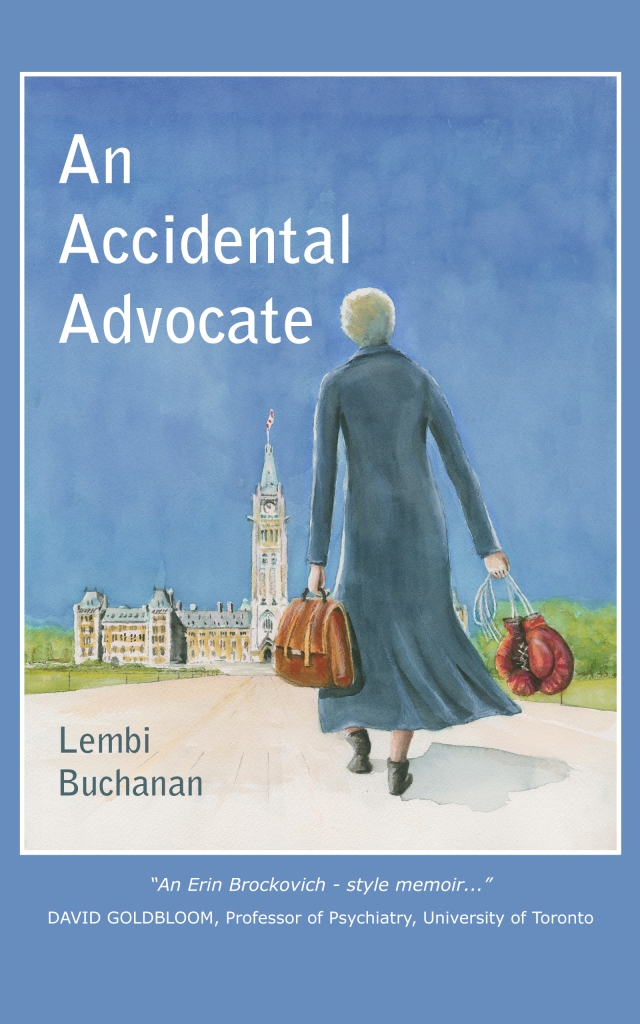

I first went to Ottawa in 2001 and I returned again and again for 20 years, trying to resolve historic injustices. I never lost my sense of hope. What I did lose was my trust in a government acting in bad faith. As recorded during the debate in the House of Commons on November 19, 2002, Wendy Lill, the Member of Parliament from Dartmouth, Nova Scotia, railed against federal tax collectors for “shaking these people down because they are easy targets, too tired, too vulnerable, and too poor to hire lawyers to fight back.”

Plain and simple, our society discriminates against people living with a mental illness. I would learn the hard truth early on in our relationship, when my husband Jim was first diagnosed with manic- depressive illness or manic depression, and more commonly known today as bipolar disorder. The fight for fair treatment meant ensuring access to the best medical care and reliable job security, and when that failed, private and public income support programs.

Over the years, I championed my husband’s causes with the expectation that the landmark judicial ruling, in the Tax Court of Canada case, Buchanan v. The Queen 2002 would benefit thousands of Canadians living with similar challenges. And yet, our federal government has continued to defy the courts by misrepresenting the legislation, making it increasingly difficult for people severely impaired in their mental functions to access the Disability Tax Credit (DTC).

Why? Are these individuals somehow less deserving than people living with physical impairments? I hope not.

Bipolar disorder is a dangerous and deadly disease when millions of neurotransmitters start firing out of sync, causing extreme mood swings affecting how people think, behave and function. This brain disease is a very complex biogenetic medical condition where heredity plays a major role in the lottery of life. Although advances in drug therapies and innovative treatments have made an important difference in the lives of people living with bipolar disorder, many continue to experience life-long disabling effects that meet the eligibility criteria as it is spelled out in the Income Tax Act.

When we met, Jim and I were two lonely people looking for love. Within days, we were deliriously happy, our emotions riding an incredible high that neither of us had ever experienced before. And yet, within weeks, without warning, the balloon burst, and we came crashing back down to Earth and with it, our dreams for the future.

Since then, I have found myself struggling on two fronts.

First of all, living with Jim is like riding a roller coaster, exciting but scary at the same time. The inability to navigate his unpredictable highs and lows often left me doubting my own instincts as a wife and mother to do the right thing. I was tired of feeling guilty for my role in Jim’s extravagant spending habits. Not that I could have stopped him. At times, I was simply overwhelmed by the burden of a disease that repeatedly disrupted our lives as I struggled with my own fears, my anger and my sense of loss.

Right or wrong, I refused to give up on Jim.

Nor was I about to let the senior bureaucrats at the Canada Revenue Agency (CRA) wear me down. Despite the odds, I was determined to beat them at their own game by ensuring that they play by the rules.

While it needs to be noted that there are some very good people at the CRA, even in the collections department, who are knowledgeable and sympathetic, the old guard still rules the roost. Over the years, they have demonstrated the brutal lack of understanding and empathy for people living with a chronic and persistent mental illness. Despite important amendments to the Income Tax Act and some improvements to the application form, it has become more difficult, if not impossible, for people living with bipolar disorder to access the DTC without appealing their case to the Tax Court of Canada.